Venture Capital deals have seen a blockbuster year (2021), but investors have turned cautious about the startup funding boom and predict that it might not sustain much longer. Although, the total global startup funding doubled in 2021, hitting a record high value of over $620 billion and a 69% jump in the number of privately held “unicorns.”

Continue readingUS Housing Prices See a Drop for The First Time Since 2008

Several indicators are now pointing towards a marginal decline in housing prices. The main reason for the drop in demand is said to be an increase in mortgage rates. Meanwhile, home listings have also dropped by 7% year on year.

Continue readingDoes The Inverted Yield Curve Signify an Incoming Recession?

Last week, the carefully monitored yield differential between the 2-year and 10-year Treasury notes inverted. The yield on two-year Treasury notes reached 2.44 %, while the yield on 10-year notes was 2.38 %.

Continue readingUnicorn Rush in India – Value or Valuation?

Unicorns were rare mythical creatures back in ancient history that were deemed to be precious and a rare sight for the eye. In terms of business acumen, companies with a billion-dollar valuation are labeled as unicorns due to the rarity of attaining such valuation.

Continue readingA Breakdown of Blockchain and Its Applications Beyond Bitcoin

The blockchain is a decentralized accounting and bookkeeping system. In contrast to the traditional ledger, blockchain is also known as a distributed ledger. A blockchain can be used for almost any purpose where data must be kept, and people must agree on it. This is not restricted to cryptocurrencies, but this is the most obvious use for most people. It is only the cryptocurrency that has brought blockchain technology to the forefront.

Continue readingWeb 3.0 – From Data Monarchy to Data Democracy

Web 3.0 is seen as the next evolution of the internet. From blockchain to AI, humankind is set to transition into the next phase of the digital revolution via Web 3.0 – the next iteration of the web. You’ve probably heard about Web 3.0 unless you’ve been living under a rock.

Continue readingThe End of LIBOR Era

For more than four decades, the London Interbank Offered Rate (LIBOR) was a significant benchmark for determining interest rates on adjustable-rate loans, mortgages, and corporate debt.

Continue readingGlobal M&A activity reaches all-time high surpassing $5 trillion in 2021

While global economies have been on a roller coaster ride over the last two years, stock markets around the world have been booming and have reached all-time highs this year. 2021 appears to be the strongest year for IPOs and listings, with 2388 IPOs raising approximately US$453.3 billion.

Continue readingUS Labour Data Miss Estimates, Likely to Impair Fed’s Tapering Schedule

When the US government reported November employment figures last week, several headline writers focused on the bad news. However, the data in the report was mixed and, to some extent, puzzling.

Continue readingThe Global Supply Chain Is In Low Supply!

While there’s no denying supply chain logistics are always evolving, it’s safe to mention 2020 caused disruptions that almost all consumer goods brands aren’t familiar with seeing. Now, in 2021, there are new challenges companies must tackle to stay successful within the competitive eCommerce space. Therewith said, a shift to online retail, increase in consumer confidence, pent-up demand, and amassed savings all add up to an amazing opportunity for digitally native brands.

Countries across the world are grappling to counter the threatening impact of the pandemic. As countries continue to be in full or partial lockdowns to contain the spread of coronavirus, the associated economic challenges are exacerbated because of the global interconnectedness of supply chains, bringing many economies to a standstill.

When the pandemic first hit, production slowed to a halt or stopped since certain commodities weren’t in demand. This also meant that shipping companies retired older vessels to cut back overhead and laid off heaps of crewmen. As the world economies open up, production is now trying to catch up to the current influx of demand which successively means more products shipping but with fewer ships and shipping companies trying to rehire crewmen, there are delays with shipping. If we dig in further, ports are being overloaded with these ships waiting weeks/months to offload.

Companies that survived the volatility of 2020 likely did so by way of getting lean, selling through inventory, and focusing on working capital. At times, the last year’s challenges have no doubt felt unwieldy. Suppliers and manufacturers from all over the world have largely been put to the test, encountering massive stock shortages, fulfillment delays, and lengthy backorders on common inventory items.

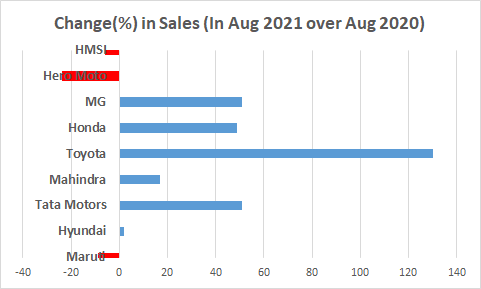

Semiconductor Chip Shortages Give Auto Industry the Jitters Ahead of the Festive Season

The semiconductor shortage has come to haunt the Indian car industry before the festive season as companies report subdued, and even lower deliveries to dealerships in August, compared to what they dispatched within the same month last year. The chip supply crunch has disrupted the production schedule of many companies such as Maruti Suzuki, Mahindra & Mahindra, and Tata Motors, and companies have said that they are being forced to go slow on the shopfloor despite healthy demand.

Although the situation is quite dynamic, the auto companies are expecting an adverse impact on the production which is unlikely to resolve soon. The lead time, which is the time taken between ordering and delivering the chip, has also increased due to shortage of raw material and unavailability of shipping containers which stands true for the countries that are part of the global manufacturing supply chain like South Korea, Vietnam, and China. This chip shortage situation came at a time when already the inventory levels are low across most of the sectors globally which have led to delayed shipments, moderate production cuts increasing the backlog of deliveries and offtake volumes in the coming months.

Bracing for impact: Supply chain risk management post Suez Canal blockage

The cargo vessel within the picture ‘EVERGREEN’ is obstructing the Suez Canal which is holding up traffic that carries goods worth nearly $10 billion every day which needs to be dislodged as soon as possible to avoid any adverse economic fallout. The importance of the canal can be understood by the very fact that just about 10% of the global trade flows through this 193 Km long Suez Canal that connects the Mediterranean to the Red Sea and provides a shipping shortcut between Europe & Asia.

The canal’s temporary blockage created a domino effect of global supply chain disruptions, exacerbating already congested ports, railyards, and distribution centers; further straining containership shortages; and delaying shipments, including the delivery of raw materials that may also impact downstream production and therefore the manufacturing of all types of goods.

The iconic shipping journal Lloyd’s List estimates that goods worth $9.6 billion undergo the canal every day. Lloyd says about $5.1 billion of that traffic is westbound and $4.5 billion is eastbound. According to shipping and supply chain data from Dun & Bradstreet and supply chain software provider E2open, the highest impacted sectors in the United States and Europe include grocery stores and restaurant chains, clothing retailers, sporting goods retailers, surgical and medical equipment suppliers, hardware stores, and automotive repair services, among others.

Global supply chains are in a state of disarray and the visible impacts of the supply chain crisis can be seen in the form of product delays, product shortages, port buildups, and rampant freight costs. Due to infrastructure deficiency and container ship challenges, the cost of shipping a container from China to LA also results in a hefty amount in the form of heavy freight costs.

Global Trade Exports

Governments across the world have pumped up liquidity by printing currency, providing fiscal and monetary support to revive consumption from the fall during the Covid crisis in 2020. Additionally, due to Covid-19 induced lockdowns and travel restrictions people tend to spend more on consumer goods in comparison to services. The above chart of global exports shows clearly that post-Q2 2020, exports have risen due to increased consumption and disposable income in the hands of common people leading to an overall increase in demand.

Apart from everything else going across the globe, China is facing a proliferating power crisis forcing the authorities to cut power across the country which is caused mainly due to the missed energy and transmission targets by the Chinese government and physical electricity shortages due to strained infrastructure leading to such a crisis hampering the manufacturing activities

Conclusion

The economic turmoil caused by the pandemic has exposed many vulnerabilities in supply chains and raised doubts about globalization. Businesses and Corporations everywhere should use this crisis to need a fresh study of their supply networks, take steps to grasp their vulnerabilities, then take actions to reinforce robustness. In many industries, technologies like Automation, Additive Manufacturing, Blockchain, and Enterprise Resource Planning (ERP) promises to upend the traditional strategy of seeking economies of scale by concentrating production in a few large facilities. They’ll allow companies to replace large plants that serve global markets with a network of smaller, geographically distributed factories that are more immune to disruption. A multisourcing strategy is additionally a vital part of diversifying the supply chain. Sometimes, the solution isn’t as simple as reshoring or nearshoring if the company’s manufacturing processes rely on precious metals or other natural resources, for instance, that only certain parts of the world produce.