The Comeback of the Decade?

On the 24th of February, 2022, the world woke up to the news of Russia launching a full-scale invasion of Ukraine. What followed were sweeping economic sanctions on Russia by the U.S., Canada, and the European Union in an attempt to financially destabilize Russia. Expectedly, the Russian Ruble crashed by over 30% in a single day.

Experts and economists worldwide thought this would cripple the Russian economy beyond recovery. Sanctions included a ban on imports of Russian crude oil and Russian banks from using the international SWIFT system. This SWIFT ban essentially meant that Russian banks could not conduct any transactions with a bank outside Russia. In addition, western countries froze the Russian Central Bank’s forex reserves of over $600 billion. These sanctions put together restricted Russia from raising or borrowing any money from western countries. Sanctions were aimed at making it difficult for the country to fund its war. Take a look at the decline in the value of the Ruble against the U.S. dollar in the week after the war began.

However, what ensued left the world shocked. As of 17 May 2022, the Ruble was inching toward breaching its five-year high. It has staged a remarkable recovery despite increasing sanctions from major economies around the world. The Ruble was trading at around 140 per USD in March 2022. Since then, it has risen to around 64 per USD while writing this article. This chart shows the massive recovery of the Ruble after 7th March 2022. Let’s explore why, despite sanctions, the Russian currency has become the best performing currency in the world, and does it mean that Russia’s economy has been revived?

Capital Controls and Interest Rates

As soon as the Ruble crashed, the Russian government was forced to introduce capital controls to stop the currency from depreciating further. Capital controls are measures that governments take to regulate the flow of currency in and out of their country. During stressed periods, governments restrict the outflow of capital from their country. In simple terms, it means that the government tries to induce the system into keeping all assets in the local currency rather than foreign currencies by making it difficult to exchange currency using various policy measures. This process increases the overall demand for the local currency and helps stabilize it.

Russia introduced a host of measures to decrease the outflow of cash from the country. Firstly, it prohibited individuals from exchanging Rubles for any foreign currency. In addition, it temporarily banned Russian brokers from selling securities of foreign entities to prevent massive outflows of capital. The government also mandated that exporters must convert at least 80% of their foreign exchange earnings to Rubles. Apart from capital control measures, the Russian Central Bank also increased key interest rates from 9.5% to a whopping 20%. All these measures were aimed at limiting the drop in value of the Ruble by restricting outflows by incentivizing users to keep assets in terms of Rubles. However, these measures alone were not responsible for the drastic rise in the currency’s value.

Russian Oil and Gas

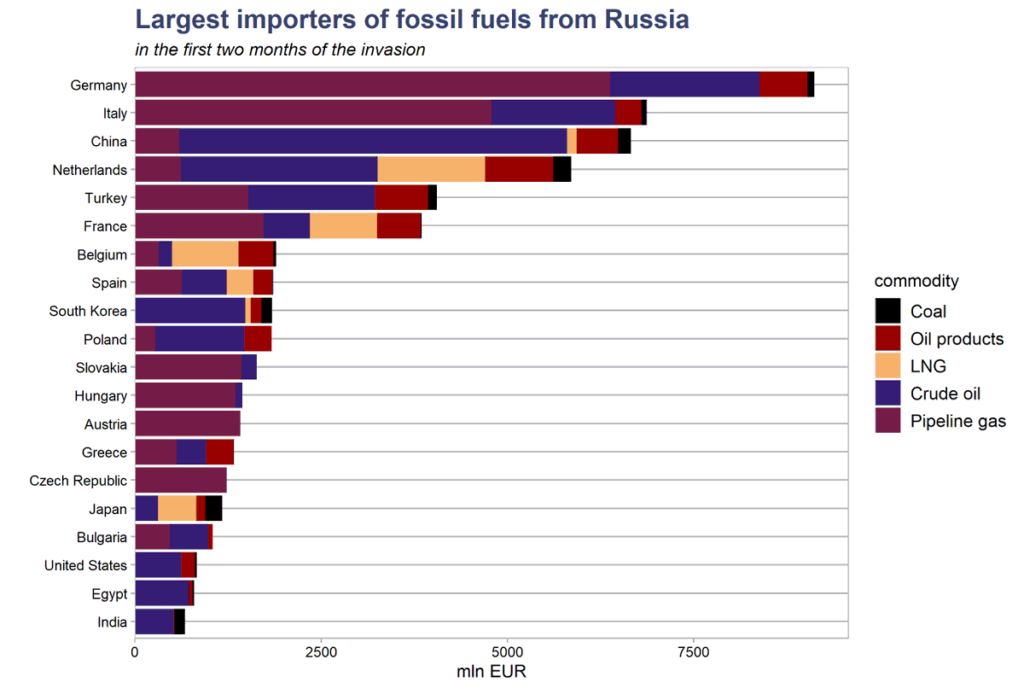

While many sanctions were put in place, there were no sanctions in place initially against Russian energy. Oil and natural gas exports form the backbone of the Russian economy. It supplies natural gas to European countries through pipelines, including Germany, Italy, and France. Twenty-five percent of Europe’s power needs are met by natural gas, and almost half of it is imported from Russia. With such increased dependence on Russia for natural gas, these countries have been unable to put sanctions on imports of Russian energy. Even oil imports were sanctioned long after the war started. The following chart shows the value of fossil fuels exported by Russia to several countries after the war began.

Fossil fuels worth an estimated $66 billion were exported by Russia in the two months following its military operation. In addition, Russia mandated some European countries to pay for natural gas in Rubles. This meant that even though sanctions were in place, these countries had to open accounts with Russian banks in order to make payments for resources. This created an additional source of demand for Rubles and played a major role in its recovery.

Does this mean that the Russian economy is back on track?

With the Ruble’s recovery, it seemed like Russia’s economy was reviving. The appreciation in the currency allowed the Central Bank to lower the interest rates drastically. Economic activity indicators too signaled that the economy was not doing badly. However, these indications do not mean that the Russian economy is back on its feet. This is because all the reasons discussed above involve a high degree of intervention from the Russian government. Russia also spent an unprecedented amount of its foreign exchange reserves. With the war still going on, these policies are not sustainable for such long periods, and their effects will fade out. In fact, Russia defaulted on some of its foreign debt due to its forex reserves being frozen.

With time, European countries too have planned to cut down on imports of Russian natural gas, with bans on crude oil already in place by many countries. Eventually, their dependence on Russia will reduce as they switch to alternatives, and a major source of revenue for Russia will dry up. Reports by the IMF and World Bank have forecasted extremely high levels of inflation in the Russian economy, making the war increasingly unsustainable with each passing day. In conclusion, even though it looks like the sanctions have failed to affect Russia in the short term, there’s a high probability that they will bring Russia’s economy to its knees in the long term.

This article is authored by Preet Singhvi

No comment yet, add your voice below!