A Reversion to Norms

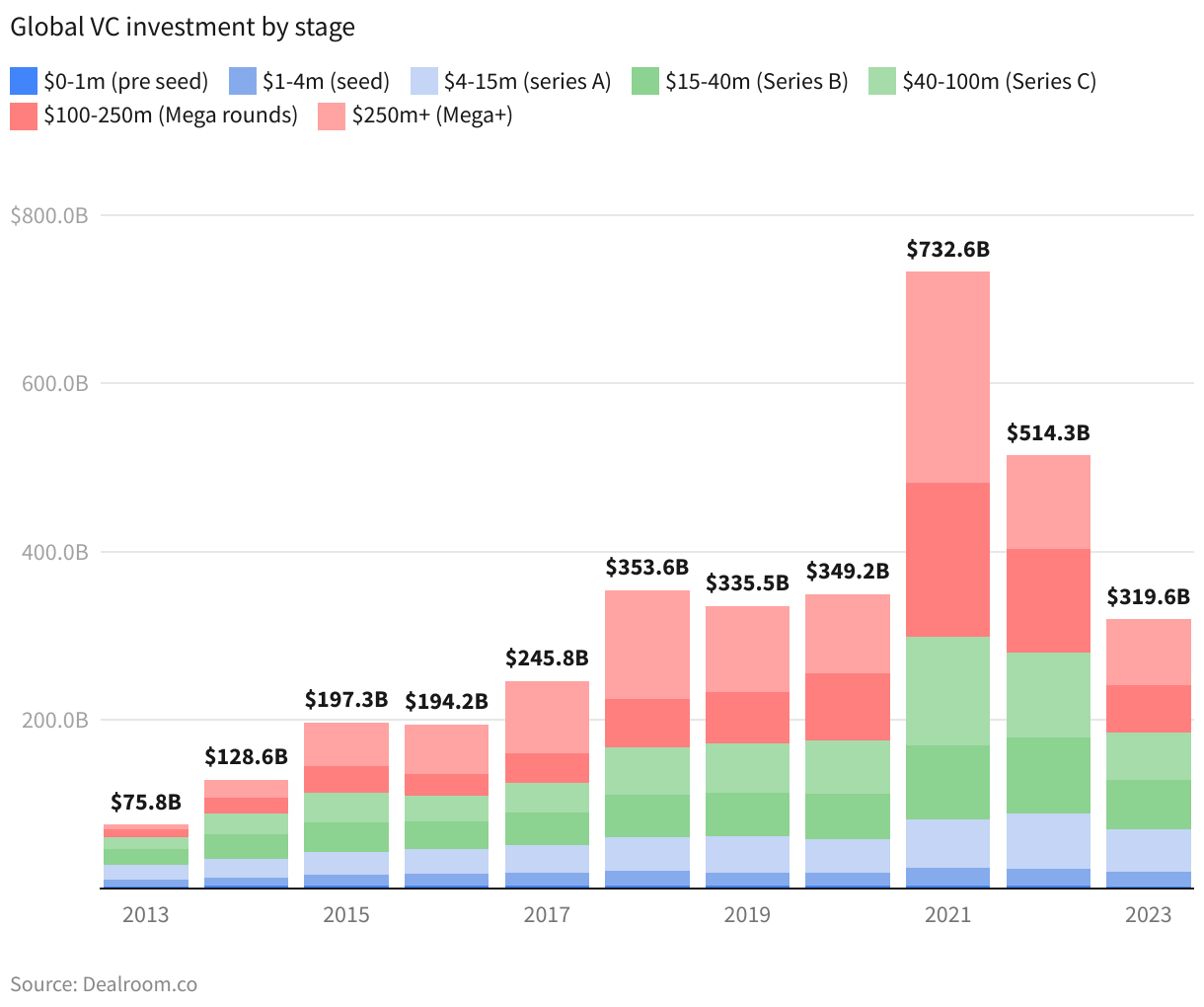

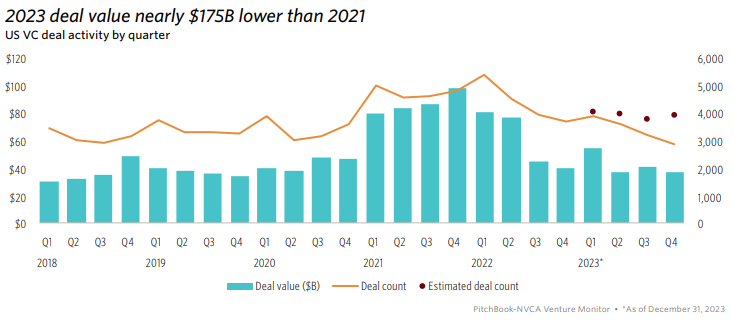

The year 2023 marked a pivotal moment in the venture capital industry, witnessing a significant shift from the heightened activity of the previous years to a more stabilized, pre-pandemic level. This recalibration was not just a mere adjustment but a comprehensive reset, reshaping the landscape of venture capital globally. The total global venture capital investment in startups reached approximately $315 billion, signaling a return to the investment levels seen before the pandemic frenzy of 2021 and 2022.

This year’s VC landscape was characterized by a blend of caution and strategic maneuvering as investors adjusted to a more sustainable pace of funding following the unprecedented surge in the preceding years. The great reset of 2023 was not merely a decline in numbers but a recalibration of investment strategies, sectors of interest, and geographical focus. This realignment was critical in setting the stage for a new chapter in the venture capital story, one that is more reflective of the enduring, structural tailwinds that support the industry.

The dynamics of the year were influenced by various global economic and geopolitical factors, including the aftermath of the pandemic, shifts in monetary policies, and evolving technology trends. These factors collectively shaped the investment decisions and strategies of venture capitalists, leading to a more prudent and data-driven approach.

Venture Capital Diversifies Globally Amid Shifting Economic Currents

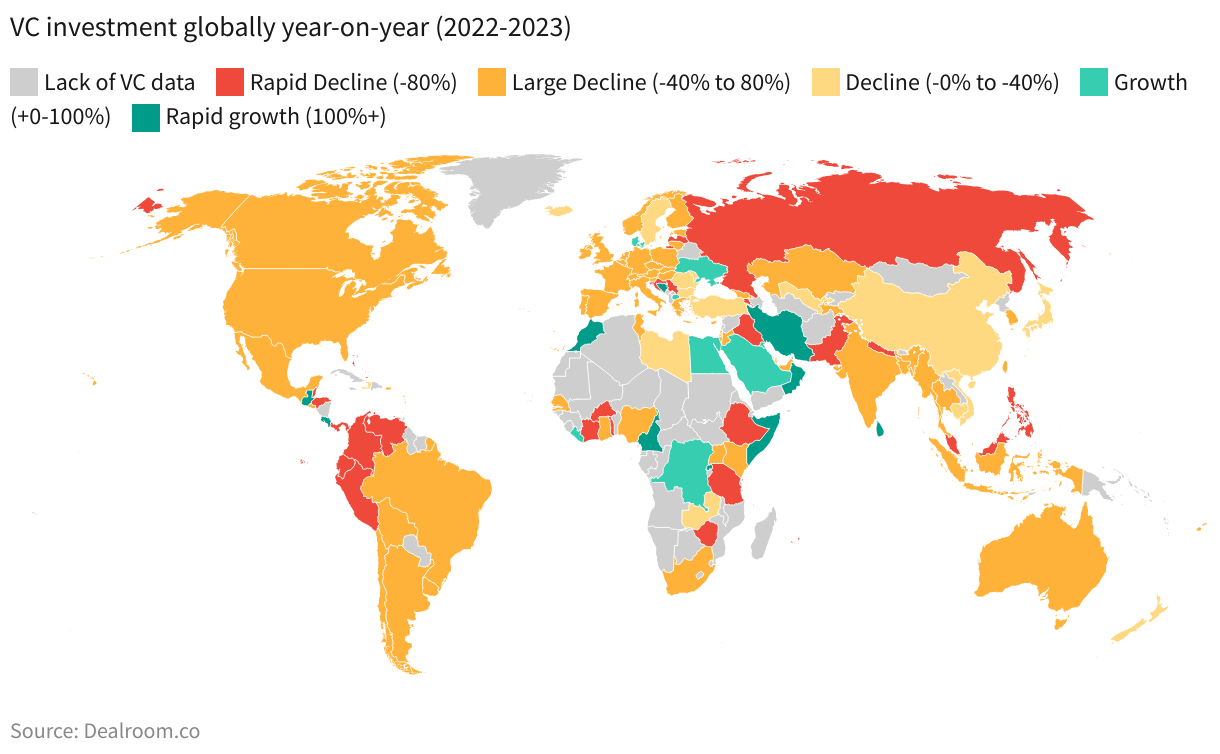

The year 2023 painted a diverse picture in terms of venture capital investment across different geographies. While the overall trend indicated a retraction in VC funding, certain regions demonstrated resilience and even growth amidst the global slowdown.

- North America’s Shifted Dynamics

North American venture capital investment saw a significant decline, falling by 40% compared to 2022 levels. This downturn reflected a broader trend of cautious investing post the hyperactive funding cycles of previous years.

- Europe’s Mixed Landscape

European venture capital investment, while generally experiencing a downturn, saw notable exceptions. Countries like Denmark, Ukraine, Bosnia & Herzegovina, and North Macedonia defied the overall declining trend. Although Europe had declining Venture funding in 2023, it reached a record level of 19.5% of global VC investment in 2023, nearly doubling since 2018.

- Asia’s Uneven Terrain

In Asia, while most countries followed the global trend of declining investment, China began to exhibit signs of recovery. After experiencing its lowest share of global VC since 2013 in the preceding years, 2023 marked the beginning of a comeback, particularly in manufacturing tech startups.

- Emerging Markets: Africa and MENA

Bucking the global trend, the startup ecosystems in the Middle East and North Africa (MENA), and Sub-Saharan Africa showed year-on-year growth in venture capital investment, highlighting the emerging potential of these regions as new hotspots for venture capital activity.

- Latin America’s Contrasting Reality

Venture capital investment in Latin America experienced a sharp decline, falling by 60% compared to 2022. Despite this overall trend, countries like Costa Rica and Guatemala emerged as outliers, showcasing growth in their VC sectors.

Where Did the Money Flow?

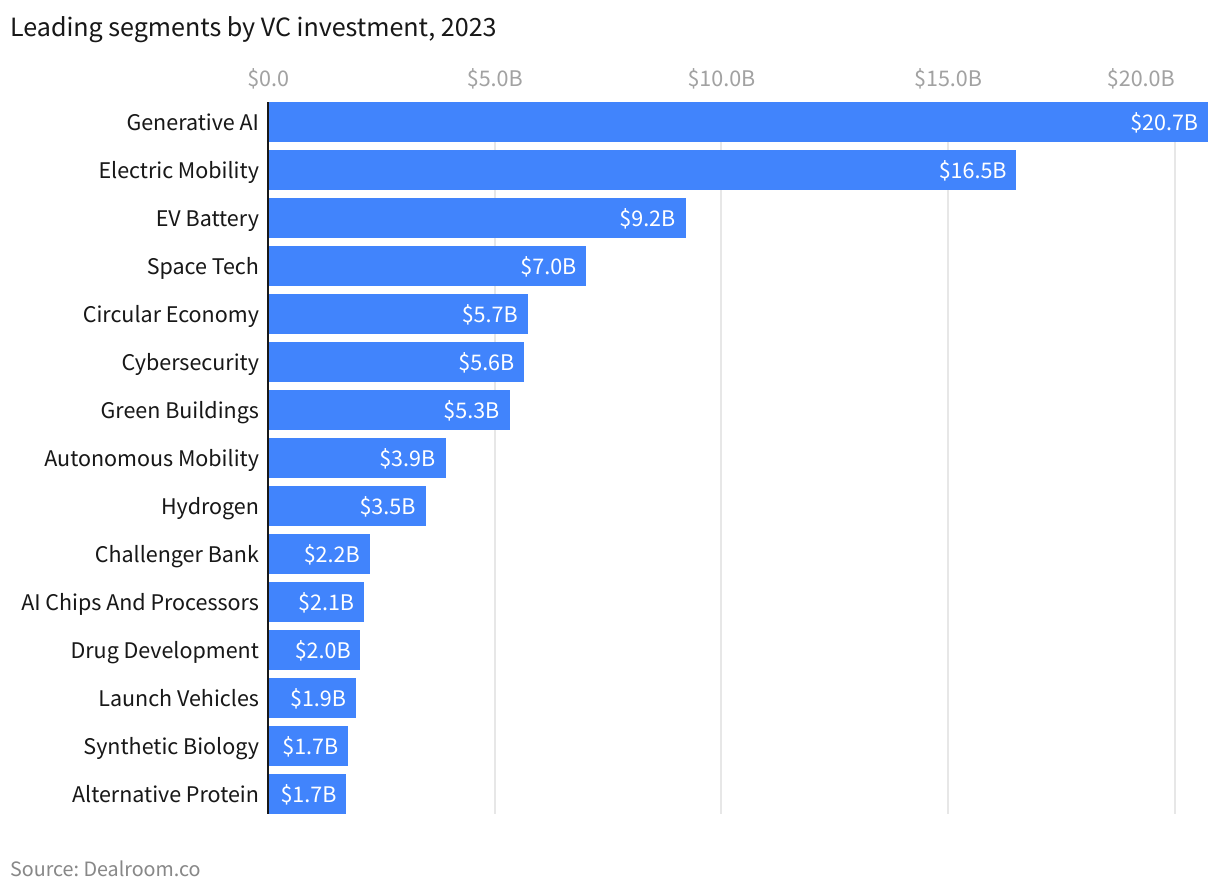

In 2023, venture capital investments were not uniformly distributed across all sectors. Certain industries emerged as clear favorites, attracting significant funding and interest from investors. Here’s a look at the sectors that stood out:

- The Ascendancy of Artificial Intelligence

Artificial Intelligence, particularly Generative AI, experienced an epochal moment in 2023. Investment in AI and its sub-segments, like GenAI model makers, increased more than fivefold year-on-year. This segment’s growth was notable even in a year when tech growth was generally subdued.

Investments spanned across the AI spectrum, indicating a broad consensus on its role as a pivotal technology for future innovation. The implications of such concentrated investments in AI suggest a reshaping of the tech landscape, with AI poised to influence a multitude of industries in the coming years.

- Electric Mobility and EV Batteries

The sectors of Electric Mobility and Electric Vehicle (EV) Battery Technology also saw substantial venture capital investments. These sectors align with the global shift towards sustainable energy solutions and reflect a growing market demand for green transportation technologies.

- Green and Sustainable Technologies

Other fast-growing segments included Green Buildings and Hydrogen technologies. These sectors align with the global focus on sustainability and carbon tracking, indicating a strong investor interest in environmentally friendly solutions.

- Fintech and Healthtech: Consistent Performers

Fintech and Health consistently topped the VC investment charts over the last five years. Their persistent performance indicates a steady investor confidence in these sectors, despite the overall fluctuations in the VC market.

- Emerging Sectors: Defense and Batteries

Defense technology and battery technologies for various applications also witnessed increased investments. These sectors likely benefited from the global geopolitical climate and the push for energy independence and security.

The sectoral distribution of venture capital in 2023 reflects a strategic shift towards technology that addresses global challenges like sustainability, health, and security. While traditional sectors like Fintech and Healthtech maintained their appeal, emerging technologies in AI, Electric Mobility, and sustainable solutions carved out significant niches, attracting substantial investments.

Corporate Influence and Crossover Funds in VC

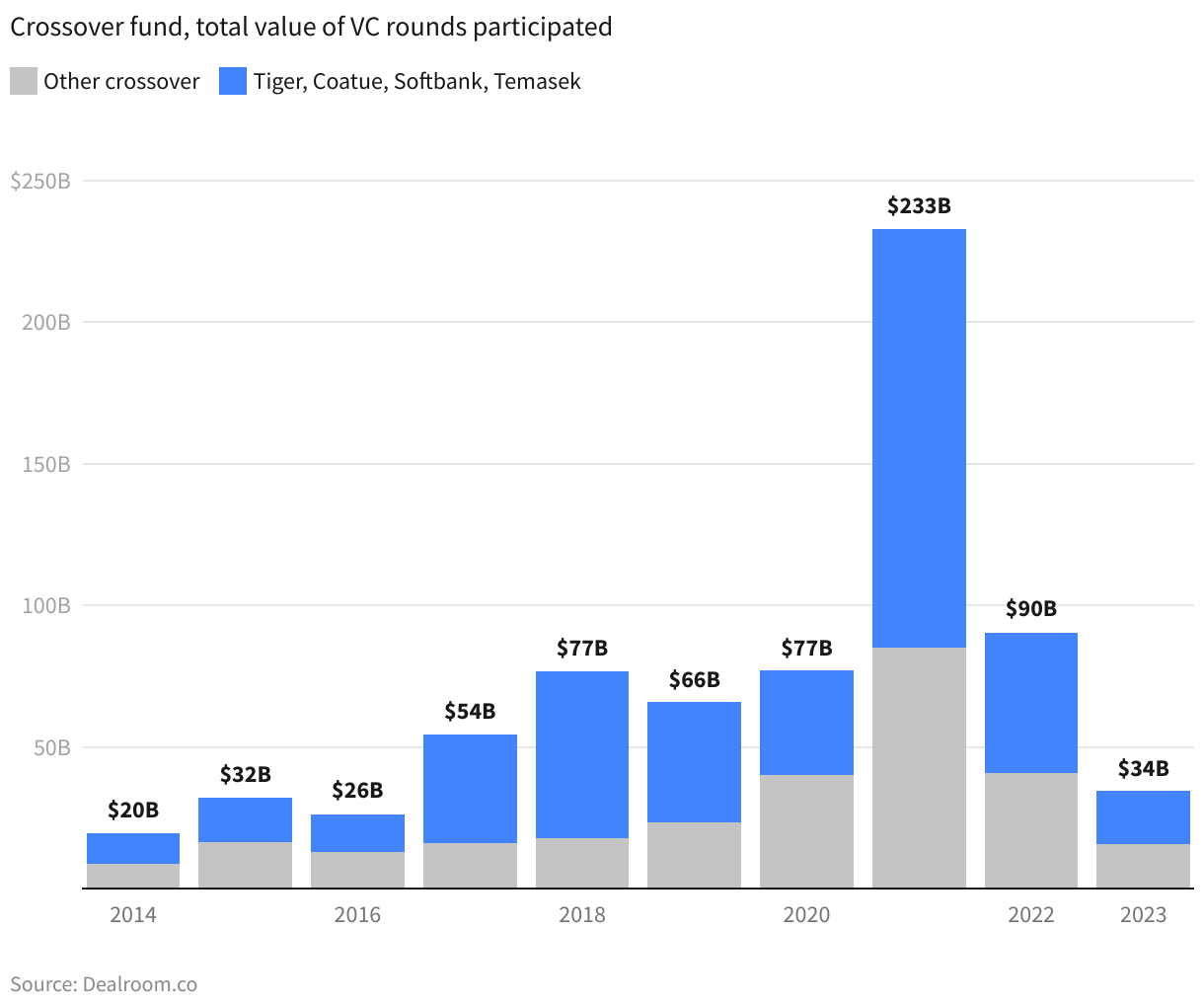

The venture capital landscape in 2023 witnessed a significant shift in the role of corporate players and crossover funds. Corporates and Sovereign Wealth Funds played a more pronounced role, picking up the slack as crossover funds scaled back their venture investments. This trend was particularly noticeable in late-stage funding, where the retrenchment of crossover funds like Tiger Global, Temasek Coatue, and Softbank had a notable impact. In 2021, these funds were part of $233 billion worth of VC deals, but by 2023, they contributed to just $34 billion.

The retreat of crossover funds, significant players in the late-stage funding arena, led to a tightening in the availability of large-scale investment capital. However, this was counterbalanced by a steady flow of corporate capital, which proved more resilient in the face of market shifts. The changing dynamics between crossover funds and corporate capital in 2023 highlighted the evolving nature of venture capital financing, where the sources of capital are as dynamic as the market itself.

Investor Prudence Amidst a Surge in Venture Entrants

In 2023, the venture capital sector saw a significant evolution in deal-making. Despite a rise in company shutdowns and bankruptcies, over 4,000 companies secured their first VC investment, signaling a robust entry into the venture cycle and hinting at a future influx of market participants. However, VC funds, once heavily skewed towards supporting early, often unprofitable startups, shifted towards a more investor-friendly model, emphasizing fiscal prudence and sustainable business models.

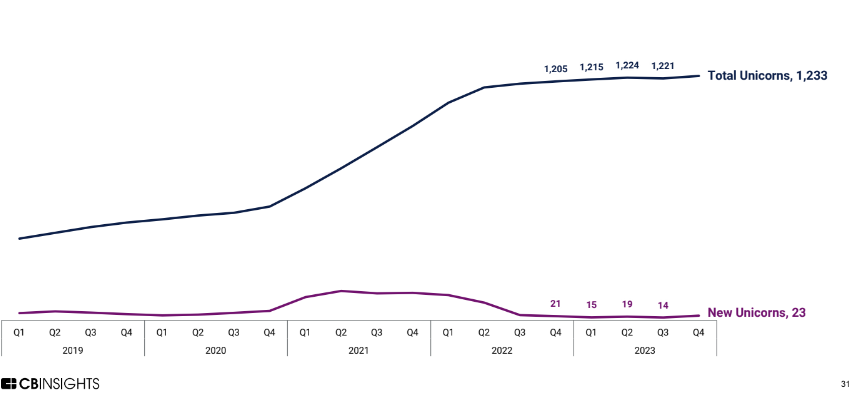

A noticeable trend is the plateauing of total unicorns after a period of rapid growth, stabilizing around the 1,200 mark throughout 2022 and into 2023. In 2023, the creation of new unicorns significantly slowed down, with the lowest numbers observed since the surge began, culminating in just 23 new unicorns in Q4. This slowdown in the emergence of new unicorns is indicative of a more challenging environment for startups to achieve billion-dollar valuations, likely due to a combination of market saturation, investor prudence, and a recalibration of valuations post the investment euphoria of previous years.

VC Exits in 2023 Depicts Sobering Reality Amid Market Subduedness

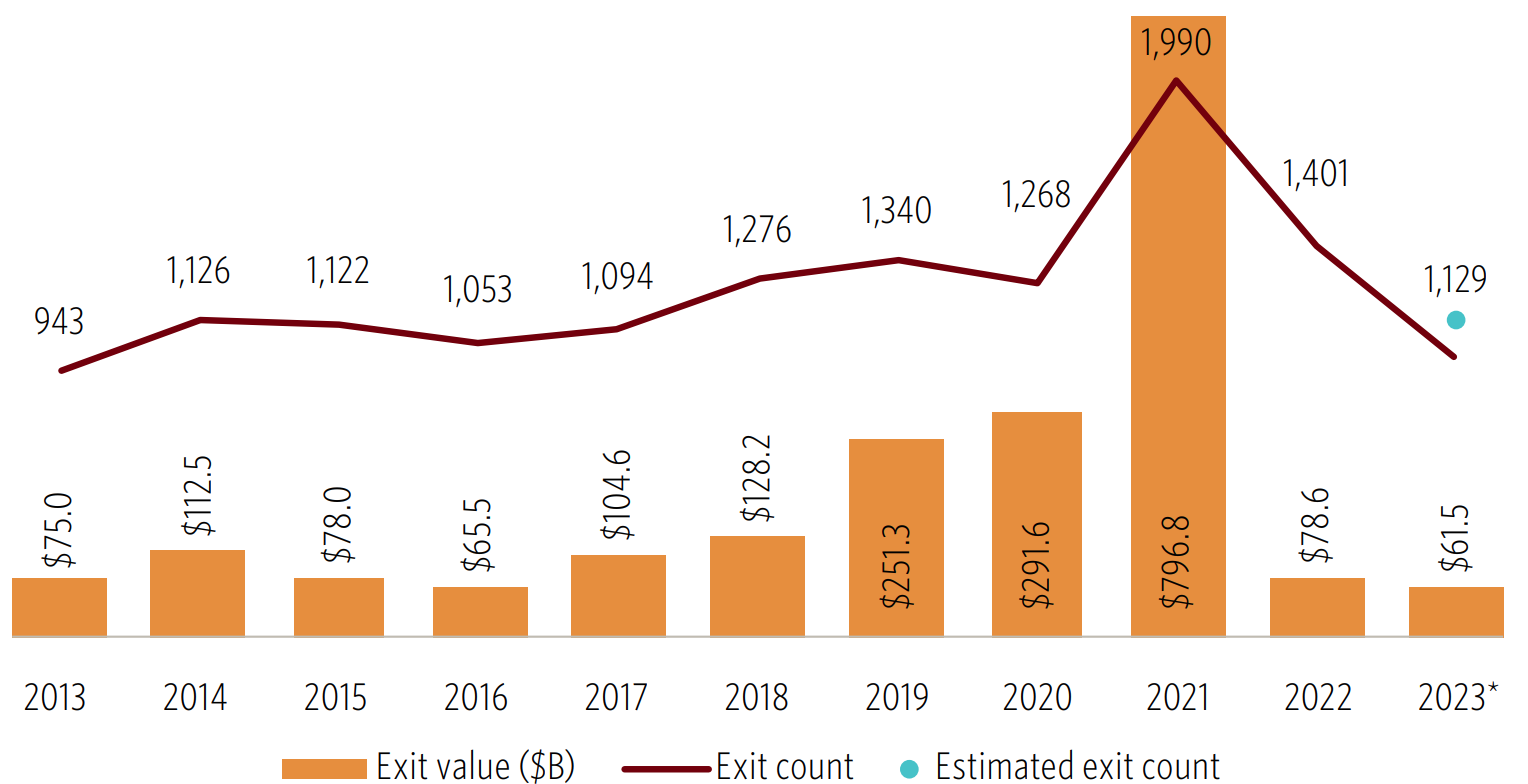

The venture capital exits of 2023 painted a stark picture, as the fourth quarter reported the lowest numbers for the year, concluding a challenging period for startups and investors alike. In the US market, the year ended with just $61.5 billion in exit value, distributed across an estimated 1,129 exit events, marking a notable decline and setting a subdued tone for the industry.

The IPO market, often seen as a beacon for successful exits, was particularly muted, with notable listings such as Instacart and Klaviyo struggling post-listing and failing to stimulate broader market activity. The fourth quarter saw a mere $1.0 billion garnered from 19 public listings, a reflection of the persistent valuation gaps between the private funding rounds and public market expectations.

Impact of Political Risks, Increased Interest Rates, and Supply Chain Disruptions

The venture capital market in 2023 was significantly influenced by political risks and increased interest rates. The geopolitical landscape, marked by uncertainties and fluctuations, played a crucial role in shaping investment strategies. Political instability in key markets and international trade tensions led venture capitalists to reassess risk profiles and geographical diversification strategies.

Moreover, the rise in interest rates had a profound impact on the venture capital ecosystem. Higher borrowing costs led to a reassessment of valuations and investment returns. Startups, particularly those in capital-intensive sectors or at earlier stages of development, faced challenges in securing funding. Increased interest rates also influenced investor appetite, leading to a preference for ventures with clearer paths to profitability and lower risk profiles.

The disruption in global supply chains, partly a consequence of ongoing geopolitical tensions and the aftermath of the pandemic, led to strategic realignments in investment preferences, particularly in sectors heavily dependent on international supply chains. Concurrently, the venture debt landscape saw an evolution, reflecting a diversification in the financial tools and strategies employed by venture capitalists. This shift was indicative of a broader trend towards innovative financing mechanisms, addressing the unique challenges and opportunities presented by the global economic environment.

Venture Capital in 2024: A Horizon of Equilibrium and Opportunity

As the curtains draw on 2023, the venture capital sector looks ahead to 2024 with tempered optimism. The market, having navigated the choppy waters of valuation corrections and cautious funding, eyes a rebound in exit opportunities with IPOs and M&A activity set to warm up. The AI sector may see a slowdown as it grapples with high valuations and legal challenges. Layoffs and startup closures could persist as the market continues to adjust. Yet, the general sentiment leans towards optimism, suggesting that the most disruptive market corrections may be behind us, with an eye on adapting to a new normal of work and investment strategies. The theme for the year is strategic investment, with a focus on sustainable unit economics and profitability.

No comment yet, add your voice below!