Introduction

Venture Capital deals have seen a blockbuster year (2021), but investors have turned cautious about the startup funding boom and predict that it might not sustain much longer. Although, the total global startup funding doubled in 2021, hitting a record high value of over $620 billion and a 69% jump in the number of privately held “unicorns.”

The graph below depicts that 2021 witnessed the highest growth in global start-up funding from 2015 to 2021. Amid the COVID-19-related economic downturn, numerous private companies saw a dramatic surge in their valuation aided by high liquidity, ultra-loose monetary policy, and accelerated adoption of digital mediums. However, 2022 is treading to be a much different story as geopolitical tensions between Russia & Ukraine, inflation, interest rate hikes, and a never-ending pandemic are starting to affect private markets. In fact, taking lessons from the past, people today have become extra cautious after the dot-com bubble and GFC, which has given birth to the “Tech Bubble Theory.”

Why Funding Startups ‘Seem’ To Be Lucrative?

According to PitchBook, which tracks private financing deals, the U.S. start-ups raised $330 billion in 2021, nearly double the 2020’s record haul of $167 billion. It can also be seen that in 2021 more tech start-up unicorns were minted than in the previous five years combined. This indicates strong confidence of VCs and exponential growth in the number of startups valuing more than a billion dollars.

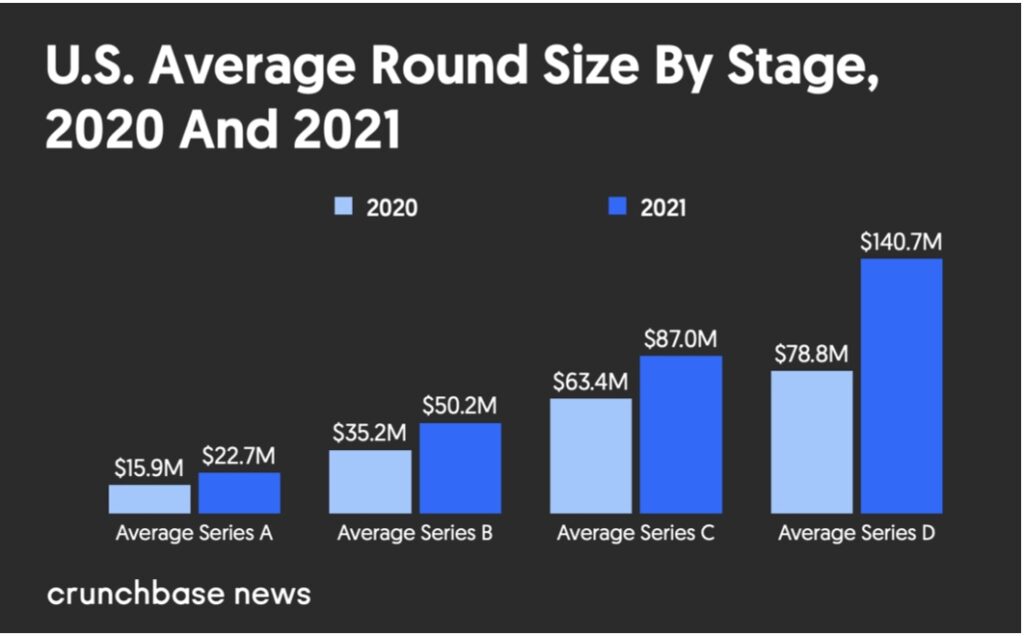

The startup funding rounds inflated in 2021, where the median amount of money raised in Series A grew by 30%, according to Crunchbase. Additionally, the value of startup exits in the form of a sale or public offering also spiked to $774 billion, nearly tripling the prior year’s returns. All these figures combined in terms of monetary returns make it lucrative for the VCs, which further leads to ‘FOMO.’

The ‘FOMO’ Factor

There are numerous factors behind the funding frenzy and euphoric startup valuations, which are all linked to a common element called ‘Fear Of Missing Out. Although fundamentally, infusion of capital into startup land, raising of larger funds by VCs at frequent intervals, market maturity, aggressive acquisition, and the strong IPO market have led to this valuation rally.

It’s so crazy that today’s hot startups no longer have to pitch investors for money; rather, it’s done vice-versa for a material stake in the form of equity and profit-sharing. Further, businesses today are valued based on several different metrics apart from the traditional profitability and revenue visibility multiples.

The venture capitalists and private equity firms are more inclined towards the potential profitability and market share in the future rather than focusing on cash flow and actual profit. Therefore, many argue that these are the dead ends that might lead to a dip in the hyped-up valuation and burst the startup bubble, as there is no reliability of such growth metrics.

The below graph shows that global quarterly mega funding rounds of more than $100 million have grown exponentially from barely above 50 rounds in Q2 2016 to almost more than 400 rounds in Q2 2021. This rally was majorly backed by the FOMO factor and missing out on attractive deals to other investors and VCs.

Today, 80% of the companies dependent on private investment are unsuccessful as, fundamentally, they are using the wrong approach to persuading investors. Startups are pushing schemes when it would be more advantageous to pull investors toward the business.

There are numerous reasons for not investing in a startup, but if the company stands out, FOMO (Fear Of Missing Out) overtakes the rational excuse of being too early, too late, or too small. That’s why today, FOMO is a big deciding factor in investing in a startup that has changed this paradigm from push to pull.

There are three ways by which the companies can ignite this FOMO factor amongst investors — Buzz, Opportunity, and Scarcity.

Exhibit 4: The ‘FOMO’ Builder Strategy.

Are The Good Times Over?

Venture funding is slowing down, as reported in February this year. Tiger Global Management, in a webinar, told its investors that large, late-stage firms planning to go public would no longer be a priority investment. Instead, the VC firm plans to shift its focus toward investing in younger startups raising Series A and B rounds.

Further, a few weeks after this announcement, the partners at Tiger Global committed $1 billion in their personal capacity to fund young companies as part of a broader strategy to index the early-stage startup market. Following the same route, even hedge funds like D1 Capital have intimated to slow down or halt funding to more mature startups and focus on early-stage companies. Even SoftBank has spun off a new entity known as Upload Ventures specifically to invest in early-stage companies in the Latin American region.

Apart from stagnated venture funding, the slowdown in investment activity has led to indexes like the NASDAQ Composite declining by almost 18% (as of April 26) and forcing private market investors to revaluate startup valuations.

Conclusion

The year 2021 was a record-setting year in terms of monthly venture investment that might well be in the rearview mirror as investors have turned a little more cautious in awarding funding to startups. Although, broadly, the interest in investing in private companies is not fading away anytime soon, and in fact, Tiger Global’s partners’ move to keep aside $1 billion to invest in early-stage ventures has just increased competition. However, the record-setting pace of growth in funding may be slowing down due to changing economic scenarios and geopolitical tensions.

This article is authored by Piyush Deora

No comment yet, add your voice below!