In an era where data reigns supreme, the adage “Never send a human to do a machine’s job,” exemplified by Agent Smith in “The Matrix,” becomes increasingly pertinent. The exponential growth in computing power, coupled with advancements in AI and ML technologies, has led to an unparalleled capacity for data handling. This evolution has sparked a new generation of solutions to longstanding challenges.

Consider the persistent issue of credit accessibility. Traditionally, access to credit has been predicated on a formal credit history, inadvertently marginalizing the underprivileged. Furthermore, the sparse distribution of banking facilities in rural areas compounds this problem, and while small-finance banks strive to bridge this gap, their reach remains somewhat limited.

Enter fintech lending, a transformative force in the financial landscape. Fintech lenders, with their diverse lending products, have revolutionized the borrowing process. Seeking a loan now translates to a simple online procedure: a few clicks, document uploads, and promptly, a loan is secured—a stark contrast to the arduous, often fruitless visits to traditional banks. This efficiency is due to innovative data collection methods and the deployment of complex algorithms that distill actionable insights from new data streams.

However, we’re far from a happy ending. Questions loom large regarding data privacy: What data should be collected, and how can we protect consumers from exploitation?

In emerging markets, such as India, the maturity of data protection laws is a work in progress. It is thus crucial for regulatory bodies like the Reserve Bank of India (RBI) to step in and moderate the zeal of these innovators, ensuring that consumer protection keeps pace with financial innovation.

Conversely, in established markets like Europe, where data regulations are more advanced, there is a robust framework to oversee tech-based financial solutions. This has led to increased compliance mandates for providers, who could benefit from assistance in navigating the complex regulatory landscape.

This is where Regulatory Technology, or RegTech, comes into play.

RegTech firms specialize in providing technology solutions that address regulation, compliance, and fraud risk management for financial institutions. Amid rising compliance costs and the burgeoning tech solution market, the RegTech sector is projected to expand at a compound annual growth rate (CAGR) of 23% from 2022 to 2032, according to Allied Market Research.

RegTech mainly helps finance firms reduce compliance costs. The domains primarily targeted are identity management and control, risk management, and regulatory reporting. RegTech platforms can also help regulators identify areas needing additional regulation and track compliance breaches, turning data into an effective ward against the evils of data.

Typical Users of RegTech

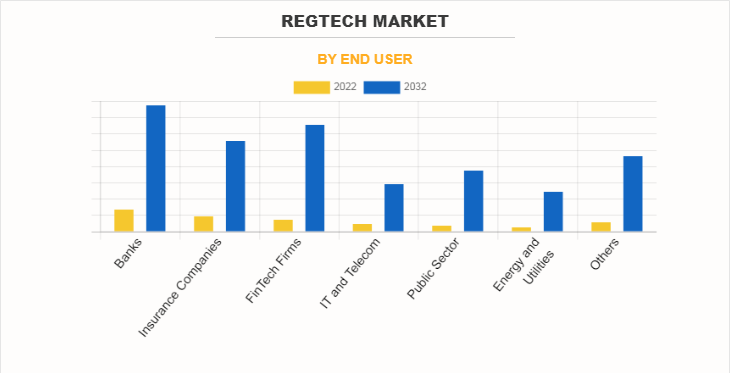

Banks command the largest share of the RegTech market due to stringent regulatory demands. They have been the earliest and most prolific adopters of RegTech solutions, which streamline compliance procedures and mitigate risks.

Insurance companies and FinTech firms also represent key segments of the RegTech market but to a lesser extent when compared to banks. IT and Telecom, as well as the Public Sector, show moderate usage, which could be due to their specific regulatory needs that are increasingly being addressed by RegTech offerings.

The projections for 2032 indicate a noticeable increase in market share for FinTech firms, suggesting an anticipation of these entities becoming more heavily regulated in the future.

Interestingly, the ‘Others’ category is projected to grow substantially by 2032. This could imply an expected diversification of RegTech applications into sectors not traditionally associated with heavy regulatory oversight, signaling an expansion of RegTech’s relevance across the broader economy.

Harnessing RegTech: A Retrospective Analysis of High-Profile Financial Frauds

The global finance sector is intricate and not immune to fraud, which has exposed weaknesses in regulatory and compliance frameworks, leading to multi-billion-dollar losses. Herein lies the importance of robust preventative mechanisms. RegTech stands at the vanguard, armed with cutting-edge tools in the fight against financial fraud. Let us delve into a retrospective analysis of three historic and three recent financial frauds to understand how RegTech could have altered their outcomes.

The Colossal Losses: Three of the Biggest Financial Frauds

History has witnessed some seismic financial frauds that shook the foundations of trust in the global economic system. These scandals not only resulted in astronomical financial losses but also eroded public confidence in financial institutions. They underscore the dire need for stringent regulatory oversight and advanced technological intervention. In the following section, we revisit three of the most devastating financial frauds to understand their magnitude and the lessons learned.

- Bernie Madoff’s Ponzi Scheme ($65 billion)

Bernie Madoff’s investment scandal was uncovered in December 2008. He defrauded thousands of investors of billions of dollars by promising them consistent profits. Madoff’s firm delivered returns to clients not through any successful investment strategy but from the principal of new investors. The scheme collapsed when Madoff could no longer sustain the required investor payments.

RegTech, with its advanced anomaly detection and predictive analytics, might have spotted the inconsistencies in Madoff’s returns earlier. Continuous verification systems could have scrutinized reported trades against actual market data, exposing the scheme’s fraudulent nature.

- The Enron Scandal (Approximately $74 billion in shareholder loss)

Enron, an American energy company based in Houston, Texas, committed systematic accounting fraud to hide debts and inflate profits. They used mark-to-market accounting and unique purpose entities to misrepresent the financial condition of the company, leading to their bankruptcy in 2001.

In this context, RegTech tools, leveraging transparent real-time ledger technologies like blockchain, could have provided an immutable record of all corporate transactions. Such visibility could have highlighted discrepancies and irregular off-balance-sheet activities, prompting earlier intervention.

- The 1MDB Scandal (Approximately $4.5 billion misappropriated)

1MDB, a Malaysian state fund, was involved in a large-scale corruption scandal with billions embezzled and misappropriated by high-profile figures. The funds were used for luxury real estate, art, and bribes, among other things, while the fund accumulated heavy debt.

RegTech, through advanced AML and compliance systems, could have scrutinized the cross-border transactions and flagged the misappropriation of funds. Using AI to identify patterns typical of money laundering could have triggered early investigations into the complex flow of funds associated with 1MDB.

A New Wave of Deception: Three Recent Financial Frauds

In contrast to the historical giants of financial deception, the new age of fraud presents a different challenge with sophisticated schemes that exploit the complex tapestry of modern finance. These recent scandals have leveraged technological advancements to disguise their nefarious activities, once again highlighting the critical role of RegTech in detecting and preventing financial malfeasance.

- Wirecard Scandal (Approximately €1.9 billion missing)

In June 2020, Wirecard, a German payment processor, declared insolvency after admitting that €1.9 billion, which was supposed to be in its accounts, did not exist. This revelation led to a dramatic drop in stock price and the arrest of its CEO.

Real-time monitoring and verification systems, hallmarks of RegTech, could have detected the missing funds earlier. AI-enhanced analytics could have challenged the veracity of Wirecard’s financial statements, potentially mitigating the fallout.

- Luckin Coffee Fraud (Overstated revenue by approximately $300 million)

Luckin Coffee, a Chinese coffee chain, fabricated sales throughout 2019, leading to an artificial inflation of its stock price. In 2020, the company disclosed that much of its previous sales reporting was false, having overstated revenues by over $300 million.

With RegTech’s forensic data analysis capabilities, inconsistencies between actual sales and reported revenues could have been identified swiftly. Predictive algorithms and machine learning models could analyze customer transactions to verify reported sales figures’ legitimacy.

- Greensill Capital Collapse (Losses in the billions)

Greensill Capital filed for insolvency in March 2021. Its collapse was partly due to the unsustainable valuation of invoices and overexposure to a single client, GFG Alliance. Disputes over insurance coverage further exacerbated the situation.

RegTech could have offered more sophisticated risk assessment tools that would monitor concentration risk and flag the overvaluation of assets. Supply chain finance platforms powered by RegTech could provide more transparency into the underlying receivables’ quality and validity.

To conclude, the staggering impact of financial fraud on the economy and stakeholders necessitates a vigilant and proactive approach to financial regulation. RegTech not only provides the necessary tools to prevent such frauds through early detection and real-time monitoring but also restores trust in economic ecosystems. As the financial world becomes increasingly digital, deploying RegTech solutions is advantageous and imperative to safeguard the sanctity of the global financial infrastructure.

No comment yet, add your voice below!