Introduction

In an increasingly interconnected world, foreign exchange reserves play a vital role in maintaining economic stability and fostering growth. Central banks across the globe manage vast reserves of various currencies, with a keen focus on maintaining a delicate balance between risk and reward. As the global economic landscape continues to evolve, so do the strategies and approaches of these financial institutions. This article delves into the importance of forex reserves, the shifting trends in reserve currency preferences, and the emergence of de-dollarization, as nations seek to diversify their holdings and reduce reliance on the US dollar. Join us as we explore the complex world of forex reserves and uncover the factors driving change in this pivotal aspect of international finance.

Why Do Forex Reserves Matter?

Being a medium of exchange to buy goods and services, money has taken various forms ever since man did away with the need to barter. When we talk about money at the macro-economic level, it mutates to foreign exchange reserves, or as commonly referred to as ‘Forex reserves or FX reserves.’

Foreign exchange reserves are cash and other reserve assets held by a central bank that is primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and maintain confidence in financial markets. Forex reserve assets can comprise bank notes, bank deposits, and government securities of the reserve currency, such as bonds and treasury bills. The past few years have been quite disastrous and crisis-laden the world over. Countries suffered from the Covid-19 pandemic, the Russia-Ukraine war, the Srilankan economic and political crisis, insurmountable inflation levels, and many more such “unforeseen events.” One of the major reasons for the need to maintain forex reserves is to tackle such unforeseen events by being sound financially so as to be able to protect the rights of individuals during such times.

Several other reasons can be listed for the need for forex reserves; to boost economic growth, attract foreign investment, fund infrastructural development, and secure the position of home currency, to name a few.

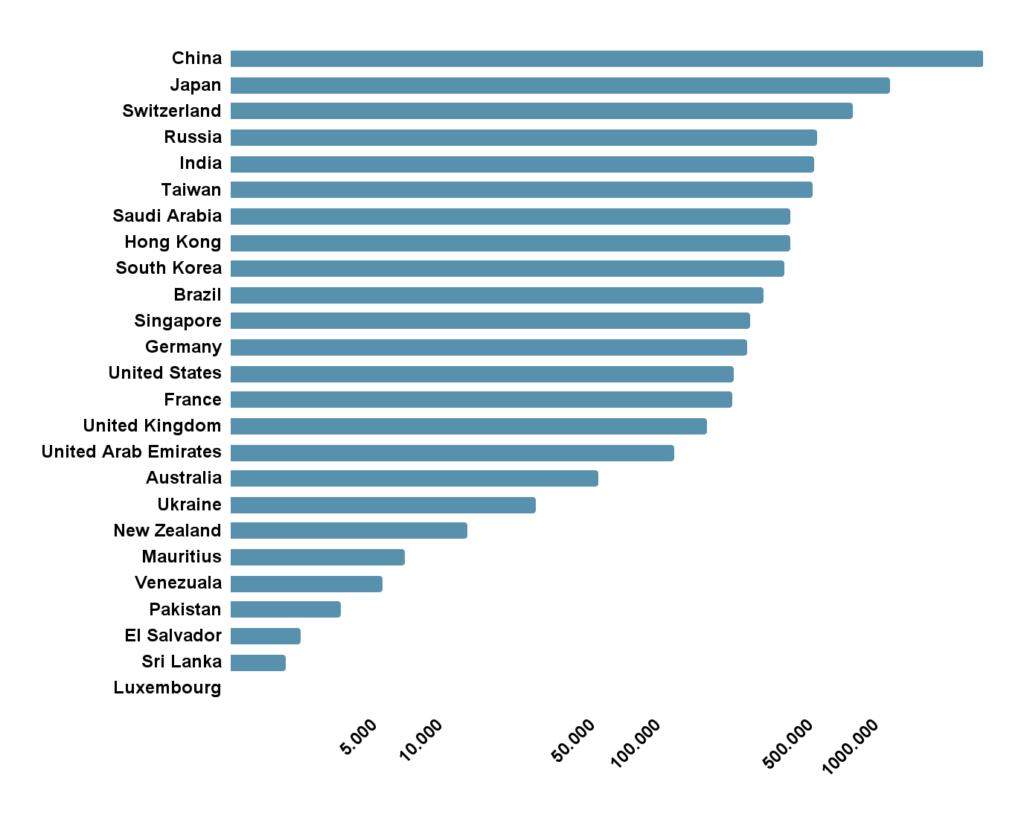

A Quick Glance at Forex Reserves of Various Countries

Forex Reserves are, strictly, only foreign-currency deposits held by nationals and monetary authorities. These foreign currency deposits are the financial assets of the central bank and monetary authorities that are held in different reserve currencies (e.g., the US dollar, The Euro, The Japanese Yen, The pound Sterling, and the Chinese Yuan) and which are used to back its liabilities (e.g., the local currency issued and the various bank reserves deposited with the Central bank by the government or financial institutions).

China’s forex reserves are and have been, the greatest of all the countries for more than 14 years, having reached a high of $4 trillion before July 2014. But, over concerns of very high levels of forex reserves, it began reducing it in July 2014, with the level dipping below $3 trillion briefly and has since remained above that level. Japan, with the second position, was the first country to reach $500 billion with the highest forex reserves in the world until overtaken by China in 2006. It is the second country to surpass $1 trillion and has remained second since 2006.

Swiss forex reserves, compiled in Swiss francs, are the third largest in the world. Since the global financial crisis of 2008, the Swiss franc has significantly appreciated against other currencies due to the country’s traditional perceived safety, which has attracted speculative foreign capital; firstly, due to the inflows of investment income by Swiss firms, and secondly due to the large surplus in the trade of goods. As a result of the resilience of the export sector and the continued inflows of capital meant that the Swiss Franc kept appreciating, the SNB has been unable to dispose of its large accumulated foreign exchange reserves since their sale would lead to an even greater appreciation of the currency.

Russia, being the third country to reach $500 billion, ranks fifth in the forex reserves. The two most declining phases in reserves the country saw were the Great Recession and falling oil prices. India, which saw its reserves decline to sadden meager $5 billion during the 1991 Indian economic crisis, holds the fourth-largest forex reserves in the world, amounting to approximately $561 billion. In 2021, the reserves with the country exceeded $600 billion unprecedently, and it became the fifth country to do so after Switzerland.

According to the latest IMF data, below is the list of the select few countries’ foreign exchange reserves which include gold reserves, special drawing rights (SDRs), and International Monetary Fund (IMF) reserve position.

Why Do Central Banks Hold Forex Reserves?

We are part of a global economy where trade is made beyond boundaries. A country’s foreign exchange reserves depend on its total imports and exports. A local exporter is paid by its trading partner in USD, CAD, Euros, or other currency. The trader deposits this foreign currency into his local bank, and in exchange, he receives local currency, which he can use for his day-to-day transactions. The local bank then transfers the foreign currency to the central bank. Forex reserves are either held by the central banks or other financial institutions such as the IMF or the International Monetary Fund. The central banks play a pivotal role in keeping the economic stability of a country. Forex reserves are those significant tools that provide liberty to the central banks to frame timely economic decisions as and when the need arises.

There have been many circumstances in history which necessitated the need for forex reserves with the central bank. For instance, in the late 1990s, several Asian countries, including Thailand, Indonesia, and South Korea, were hit by a severe economic crisis. These countries had been borrowing heavily in foreign currencies, and when their currencies depreciated sharply, they were unable to repay their debts. However, countries like China and Japan, which had built up substantial forex reserves, were able to weather the storm better. They were able to use their reserves to stabilize their currencies, protect their financial systems, and provide liquidity support to their banks. The same was the case with Brazil and Russia, which had built huge forex reserves, which helped them to use their reserves to stabilize their currencies, provide liquidity support to their banks, and manage their external debt obligations during the global financial crisis of 2008-2009.

Too Much Too Fast

But if everything revolves around just money – how we get it and how we spend it, why can’t, then poorer nations print more currency and become rich fast? The problem with the situation can be best understood with the most infamous incident of Zimbabwe, being hit by hyperinflation in 2008, when the prices of goods rose to up to 231,000,000% in a single year when the country printed more money to try to make their economies grow. That is, when a country tries to get richer by printing more money, everyone has more money, and paradoxically, prices go up instead, leading to a vicious circle of inflation. Imagine, chocolate which cost one Zimbabwe dollar before the inflation would have cost 231m Zimbabwean dollars just a year later; and the amount of paper would probably be worth more than the banknotes printed on it!

To overcome the problem of hyperinflation, people can barter goods or services or ask to be paid in US dollars instead, which even happened in Zimbabwe during that period. Now, even if a government intervenes and passes anti-inflationary laws on foods and medicines, the supply won’t be enough to cater to such demand.

The value of any currency is determined on the basis of the country’s ability to manufacture things and the capacity of the people of the country to buy such things. So, to get richer, a country has to make and sell more goods or services, thereby increasing the demand for the things requiring more currency to buy such things. If the country just prints more money without making more things, the prices just go up, and people will stop using that money.

However, the US dollar enjoys an exception in this case since the majority of the valuable things that countries around the world trade with one another, be it gold or oil, are priced in US dollars. It can just print more dollars and buy more things, though if it printed too many of them, the prices of even those things in dollars would still go up.

How the “Greenback” Became a Safe-haven Currency

Reserve currency is the most significant international currency held by central banks all over the world as part of their forex reserves programme. For any currency to be on the list of the most demanded currency, it is essential that the currency should be of the most stable economy, both politically and economically, and with high credit ratings, thus building investors’ confidence and trust in the currency and the economy.

The US dollar or Greenback, as it is often times referred to, fulfilled all the criteria of being a reserve currency, with the US being the most stable economy both politically & economically and with high credit ratings. Due to the above reasons, investors often flock to safe-haven assets, such as US Treasury bonds and the US dollar, as a way to preserve their wealth and reduce their exposure to riskier assets. As of today, the US dollar is the world’s most widely held reserve currency, accounting for about 60% of global forex reserves. This increases demand for the US dollar, which further enhances its safe-haven status. But this can have a negative impact too on the world economy as the famous saying has it, ‘When America sneezes, the rest of the world catches a cold,’ which can be observed with the rampant dollar at a two-decade high crushing most currencies’ buying power in international markets, fears of an economic downturn and burned foreign exchange reserves point to a record number of developing nations now in dire straits. This brings us to the next topic in discussion.:

Why Don’t Developed Countries Keep Foreign Reserves of Developing Countries?

In this global economy, developed countries wield considerable power and influence, with their decisions echoing across borders and shaping the financial landscape. One of these crucial decisions is the composition of their foreign reserves, and understanding why they often avoid holding large amounts of developing countries’ currencies can shed light on the complex interplay of risk, trade, and global politics that drives the international financial system As we delve into the captivating realm of foreign reserves, let’s explore the key reasons why developed countries are reluctant to keep significant amounts of developing countries’ currencies in their reserves:

- Stability: In the world of foreign reserves, stability is king. Developed countries prefer to hold assets that are less likely to experience drastic fluctuations in value. Major currencies like the U.S. dollar, euro, British pound, and Japanese yen, which are backed by strong economies and financial systems, fit the bill perfectly. In contrast, the currencies of developing countries can be more susceptible to volatility due to factors such as political instability and economic uncertainty.

- Risk Management: Developed countries need to manage the risks in their foreign reserves portfolios carefully. Developing countries’ currencies tend to be more volatile, and holding them in large amounts could introduce unnecessary risk. To maintain a well-balanced and diversified portfolio, it is more prudent for developed countries to focus on the stable and liquid assets issued by other major economies.

- Trade and Investment: In the intricate web of global trade and investment, developed countries often have stronger ties with other developed nations. Major currencies are widely used for international transactions, making it practical for countries to hold reserves in the currencies of their key trading partners or nations where they have significant investments.

- International Debt: The management of international debt obligations is another crucial aspect of foreign reserves. Most of this debt is denominated in major global currencies, so it makes more sense for developed countries to hold reserves in those currencies to meet their obligations.

- Limited Global Influence: Developing countries’ currencies typically have less impact on the global financial market compared to major reserve currencies. Holding significant amounts of these currencies may not provide substantial benefits in terms of international financial influence or bargaining power for developed countries.

De-dollarization and Reducing Influence of the Greenback

De-dollarization refers to the process of countries reducing their reliance on the U.S. dollar in international trade, finance, and as a reserve currency. This phenomenon has gained momentum over the past few years as an increasing number of nations seek alternatives to the dollar in the face of shifting global power dynamics and economic sanctions imposed by the U.S. on certain countries. The dominance of the U.S. dollar as a global reserve currency has been gradually diminishing, as evidenced by its decreasing share of foreign exchange reserves. During the last quarter of the previous year, data from the International Monetary Fund’s Currency Composition of Foreign Exchange Reserves (COFER) indicated that the U.S. dollar made up 58.36% of global foreign exchange reserves, marking one of the lowest percentages ever recorded, considerably declining from its peak of approximately 72% in 2001.

Central banks have been diversifying their foreign exchange reserves by purchasing gold, as well as other currencies. According to a World Gold Council (WGC) survey, 80% of the 57 central banks surveyed expect to expand their gold reserves, with emerging markets and developing economies being particularly inclined towards this trend. The continuous accumulation of gold reserves by central banks can be seen as a way to hedge against the declining value of the U.S. dollar and as a reflection of their dwindling confidence in its status as a global reserve currency.

Several countries have taken steps to move away from the U.S. dollar as a reserve currency, with Russia and China being the most prominent examples. Russia began de-dollarizing its economy after the annexation of Crimea in 2014, which led to Western sanctions and restricted Russian access to Western financial markets. The process of de-dollarization has gained momentum in recent times, particularly after the Russia-Ukraine war began. Moscow responded by reducing its dollar holdings, increasing its gold reserves, and pursuing bilateral trade agreements with countries like Turkey that involve non-dollar transactions.

China, as a rising global economic power, has also been steadily diversifying its reserves away from the U.S. dollar. In July 2021, it was revealed that China’s holdings of U.S. debt had fallen below $1 trillion for the first time in 12 years, a trend that began in 2017 amid the intensifying trade war between the U.S. and China. Moreover, China’s increasing presence in Middle Eastern markets, particularly in the oil sector, has raised the possibility of oil transactions being priced in the Chinese yuan instead of the U.S. dollar, which could significantly alter the global financial landscape.

Additionally, smaller nations like Egypt have been considering issuing debt in alternative currencies, such as the Chinese yuan, to help mitigate the risks associated with dollar-denominated debt. This move highlights the growing interest in exploring options beyond the U.S. dollar for trade, investment, and financial stability.

In conclusion, de-dollarization has emerged as a global trend driven by shifting geopolitical dynamics, economic sanctions, and a decline in confidence in the U.S. dollar as a reserve currency. Countries like Russia, China, and even smaller nations have taken steps to diversify their reserves and reduce their reliance on the dollar, opting for alternative currencies and gold purchases. This ongoing shift has the potential to reshape the global financial landscape, with the U.S. dollar’s dominance as a reserve currency being gradually eroded.

Conclusion

In conclusion, the ever-changing landscape of global economics has prompted central banks to adapt their strategies and diversify their forex reserves. As nations navigate these complexities, the importance of foreign exchange reserves in maintaining economic stability and facilitating growth remains paramount. The gradual shift away from the US dollar and the growing interest in other reserve currencies reveals a dynamic environment in which countries must remain vigilant and responsive to global trends.

No comment yet, add your voice below!