BCG Matrix is a simple yet powerful tool

The BCG Matrix or the Growth-Share Matrix is a very popular portfolio planning model which was developed by Bruce Henderson, founder of the Boston Consulting Group (BCG). It is a handy business tool which evaluates the strategic position of the business brand/product portfolio and its potential. It classifies business portfolio into four categories based on industry attractiveness (Market Growth Rate) and competitive position (Relative Market Share).

Relative market share. One of the dimensions used to evaluate business portfolio is relative market share. Higher the corporate’s market share, higher the cash returns. This is because a firm that produces more benefits from higher economies of scale and experience curve, which results in higher profits. Nonetheless, it is worth to note that some firms may experience the same benefits with lower production outputs and lower market share.

Market growth rate. High market growth rate means higher earnings and sometimes profits, but it also consumes lots of cash, which is used as an investment to stimulate further growth. Therefore, business units that operate in rapid growth industries are cash users and are worth investing in only when they are expected to grow or maintain market share in the future.

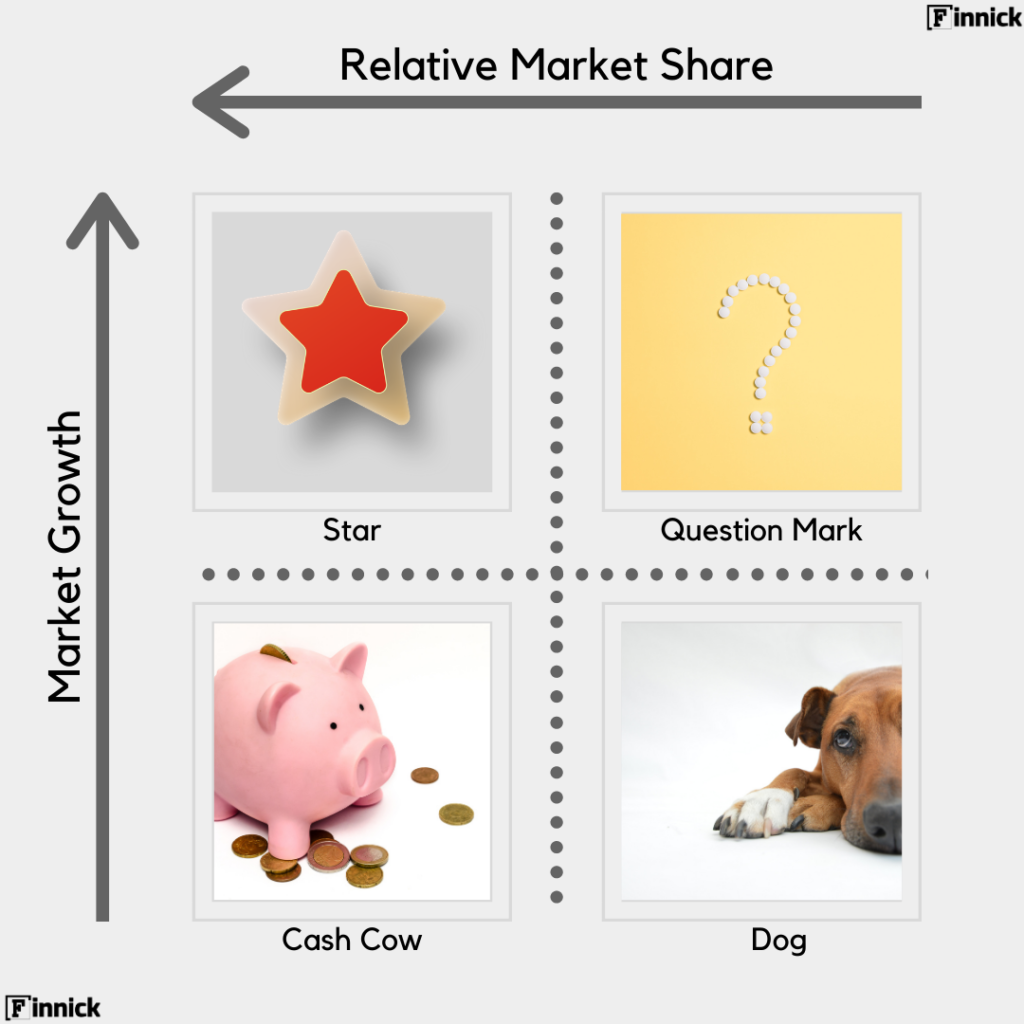

On a 2 x 2 Matrix [High and Low] and [Market Growth and Relative Market Share], it produces four quadrants which are shown in the infographic below:-

Originally, the BCG Matrix was made to analyse the product portfolio and to provide a strategy for analysing products according to growth and relative market share.

Below is the original breakdown of the BCG Matrix, according to Wikipedia

- Cash cows are where a company has a high market share in a slow-growing industry. These units typically generate cash in excess of the amount of cash needed to maintain the business. They are regarded as staid and boring, in a “mature” market, yet corporations value owning them due to their cash-generating qualities. They are to be “milked” continuously with as little investment as possible since such investment would be wasted in an industry with low growth. Cash “milked” is used to fund stars and question marks, that are expected to become cash cows sometime in the future.

- Dogs, more charitably called pets, are units with a low market share in a mature, slow-growing industry. These units typically “break-even”, generating barely enough cash to maintain the business’s market share. Though owning a break-even unit provides the social benefit of providing jobs and possible synergies that assist other business units, from an accounting point of view such a unit is worthless, not generating cash for the company. They depress a profitable company’s return on assets ratio, used by many investors to judge how well a company is being managed. Dogs, it is thought, should be sold off once short-time harvesting has been maximised.

- Question marks (also known as adopted children or Wild dogs) are businesses operating with a low market share in a high-growth market. They are a starting point for most businesses. Question marks have the potential to gain market share and become stars, and eventually, cash cows when market growth slows. If question marks do not succeed in becoming a market leader, then after perhaps years of cash consumption, they will degenerate into dogs when market growth declines. When the shift from question mark to star is unlikely, the BCG matrix suggests divesting the question mark and repositioning its resources more effectively in the remainder of the corporate portfolio. Question marks must be analysed carefully to determine whether they are worth the investment required to grow market share.

- Stars are units with a high market share in a fast-growing industry. They are the “graduated” question marks with a market- or niche-leading trajectory, for example: amongst market share front-runners in a high-growth sector, and/or having a monopolistic or increasingly dominant unique selling proposition with burgeoning/fortuitous proposition drive(s) from: novelty, fashion/promotion (e.g. newly prestigious celebrity-branded fragrances), customer loyalty (e.g. greenfield or military/gang enforcement backed, and/or innovative, grey-market/illicit retail of addictive drugs, for instance, the British East India Company’s, late-1700s opium-based Qianlong Emperor embargo-busting, Canton System), goodwill (e.g. monopsonies) and/or gearing (e.g. oligopolies, for instance, Portland cement producers near boomtowns), etc. The hope is that stars become the next cash cows.

Stars require high funding to fight competitors and maintain their growth rate. When industry growth slows, if they remain a niche leader or are amongst the market leaders, stars become cash cows; otherwise, they become dogs due to low relative market share.

As a particular industry matures and its growth slows, all business units become either cash cows or dogs. The natural cycle for most business units is that they start as question marks, then turn into stars. Eventually, the market stops growing; thus, the business unit becomes a cash cow. At the end of the cycle, the cash cow turns into a dog.

Applying BCG Matrix in Investing

In this article, we will see how BCG Matrix can also be used for making investment decisions.

When you analyse a company, it is very instructive to look at the portfolio of the company. Let’s take an example of one of India’s most debated scrip, ITC Limited.

Cigarettes and tobacco verticles (Gold-Flake, Insignia, etc.) are Cash-cows for them as they have a substantial market share with slow/low growth prospects. When the verticles like Food and FMCG (Aashirvaad, Sunfeast, Classmate) were introduced, they were a question mark, which quickly became Stars. Hotels and Lifestyle (Wills Lifestyle, Fiama, Engage) are still a question mark, i.e. they can make it to stars or degenerate to dogs. Verticles like ITC Infotech are Dogs.

Today, ITC is busy milking this cow and hopefully use the cash to fund new Question Marks that will help the company grow (and survive) in the coming years. If the Question Marks (also called “pipeline”) is bare, that raises a lot of questions about the future of the company.

The above also holds true for companies as a whole (and not just the products in its portfolio). Generally, Big Retail and FMCG companies that sell a sticky product are Cash Cows. Startup companies are Question Mark (even those heavily funded Startups), and a fast-growing Crypto-tech or an AI-based company may be a Star. Companies with low or negative growth rate and loss-making enterprises are Dogs.

What do Investors look out for?

There are two types of approaches to investing, i.e. Value Investing and Growth Investing. Growth stocks are considered stocks that have the potential to outperform the overall market over time because of their future potential, while Value stocks are classified as stocks that are currently trading below what they are really worth and will, therefore, provide a superior return.

Value investors focus on good companies and often look for businesses with competitive advantages; thus, they are attracted to Cash Cow businesses. The valuation of the stock has to be attractive as well. Sometimes, Classic value investors also look out for mispricings in Dog businesses.

Growth investors, as the name suggests like to invest in Star businesses. They invest with the expectation that these stars will continue to grow until they become Cash cows.

Cash cows aren’t always permanent.

Some Cash cows are permanent while some aren’t able to stay as a cow for long, i.e. they become Dog. Coca Cola is a well-known business which has been operating as a Cash cow for more than a century now. Whereas, Kodak, one time the world’s biggest film company, could not keep up with the digital revolution and eventually became a Dog from a Cash cow.

Conclusion

Companies use BCG Matrix to analyse its product portfolio. In the same way, you can use BCG Matrix to analyse your portfolio (here, for you, companies are the product). You will obviously need to amend some of these metrics because here you are more concerned about stock prices and their returns.

No comment yet, add your voice below!